term life insurance policy

Options start at 995 per month. You have the option to convert your coverage.

Compare Life Insurance Quotes Find The Cheapest Rates October 2022

A term life insurance policy can be a great way to help protect a familys financial future.

. Ad Get an instant personalized quote and apply online today. Ad 5 Best Life Insurance Policies of Oct 2022. This is the portion of a permanent life.

Obviously with the increasing assured money. The key to term life insurance is the term -- if you die after the 20-year term expires your loved ones wont receive a payout. Its affordable and simple it may make sense if you only want protection for the years.

Term life insurance rates best online term life insurance best term life rates best term life insurance for over 50 difference between term life and whole life term life insurance rates. All policies expire at age 80 and policyholders can choose to convert to a permanent life. Compare 2022 Best Term Life Insurance Providers.

If you die while the policy is in force youll leave behind a lump sum of cash for whomever you choose. You have a growing family and the financial obligations that come with it. Reviews Trusted by 45000000.

18 hours agoThe average cost for a 10-year term life insurance policy is 180 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life. Ad Get Matched with Your Ideal Term Life Insurance Policy. As soon as you know you need life insurance you should buy in order to lock-in lower life insurance premiums.

Term life insurance provides death protection for a stated time period or term. Ad Help protect your savings other assets with long-term care options from New York Life. 10- 15- 20- and 30-year terms available.

You cant be turned down due to health. Term life insurance provides coverage for a specific period of time or term of years. Ad In New Jersey Find a 500K Term Life Policy for as Low as 1355mo.

There are permanent life insurance policies that dont. Term life insurance can help you bridge that gap at a relatively low cost. Policyholders get covered for a specific amount of time or term and pay less on premiums.

If the policyholder dies of a covered cause while coverage is in effect the. We Can Help You Find The Right Length Level Of Coverage To Fit Your Life. Term Life Insurance is a type of life insurance policy that covers the policyholder for a specific amount of time which is known as the term.

If you have dependents. Simply multiply your income by 10 to quickly estimate how much life insurance you should buy. If the insured person dies within the term of the policy and the policy is still in force active then.

Buy life insurance as soon as you need it. Ad Compare 2022s Best Life Insurance Providers. Find the Best Rates Quotes for Term Life Insurance Policies Using Our Chart.

This is the amount of time you are covered by a term life insurance policy eg 10 15 20 or 30 years. Ad A Life Insurance Policy You Can Trust At A Price That Works For You. Apply to Protect Your Family Finance Future.

Ad Get A Term Life Insurance Policy That Fits Your Needs Goals Budget. Reviews Trusted by 45000000. Ad A Life Insurance Policy You Can Trust At A Price That Works For You.

Learn more by downloading a free guide. Dont delay prepare for the future today. Typically 10 15 20 or 30 years.

Term life insurance provides coverage for a specific amount of time. Reduce the Cost the Burden on Your Family with Affordable Reliable Term Life Coverage. The term lengths vary according to what the.

Apply for guaranteed acceptance life insurance. AARPs term life insurance policy is unique in that it isnt offered in term lengths. Since it can be purchased in large amounts for a relatively small initial premium it is well suited for short.

The incremental term life insurance policy is the kind of policy where the cover amount of the term policy is increased annually. Just a Click Away for Saving Money Time While Protecting Your Loved Ones. Some say multiplying by 5 is enough while the Government of Canada.

Lets say you have a house with a 30-year mortgage a 48-month auto loan and a college fund. A term life insurance policy is a type of insurance in effect for a limited time such as 20 or 30 years. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

Talk To An Advisor. Term life insurance is a policy that provides a lump-sum tax-free payoutcalled a death benefitto your loved ones if you die while the policy is active. Compare 2022s Best Options Now.

Determining Which Term Life Insurance Policy Makes The Most Sense Merriman

What Is Term Life Insurance Banner Life Legal General America

Term Life Insurance Advantages And Disadvantages Effortless Insurance

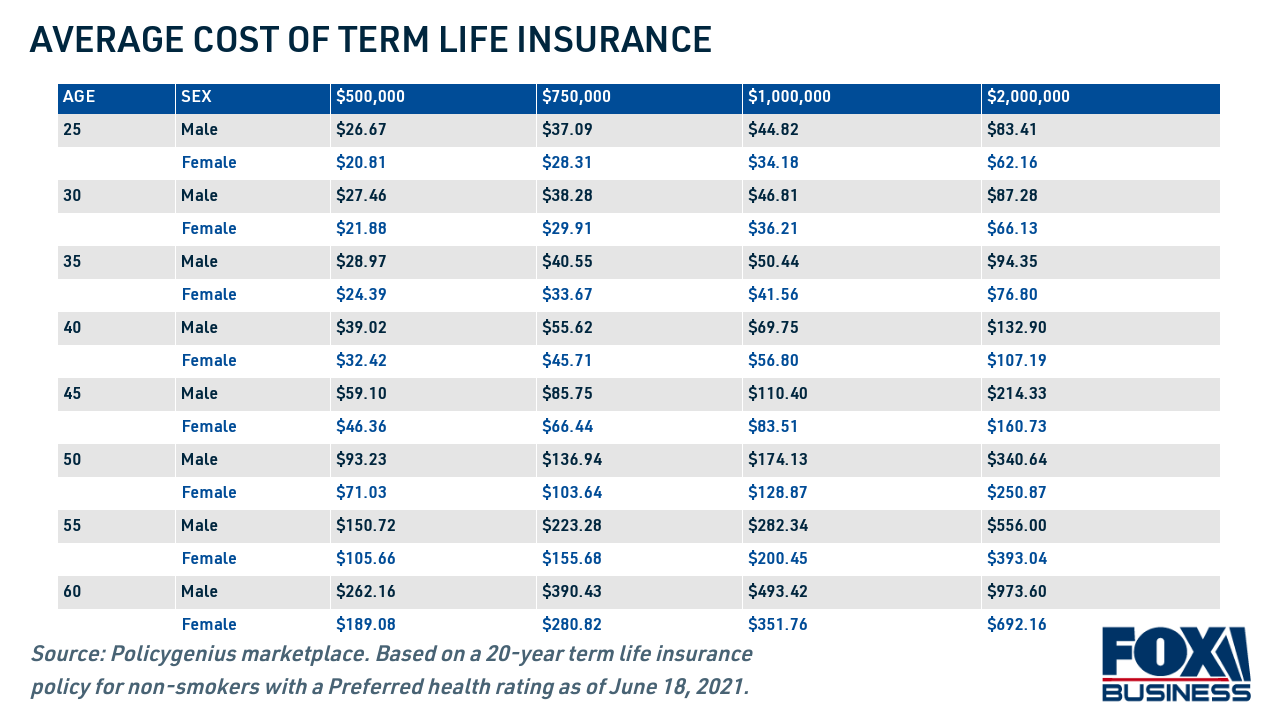

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

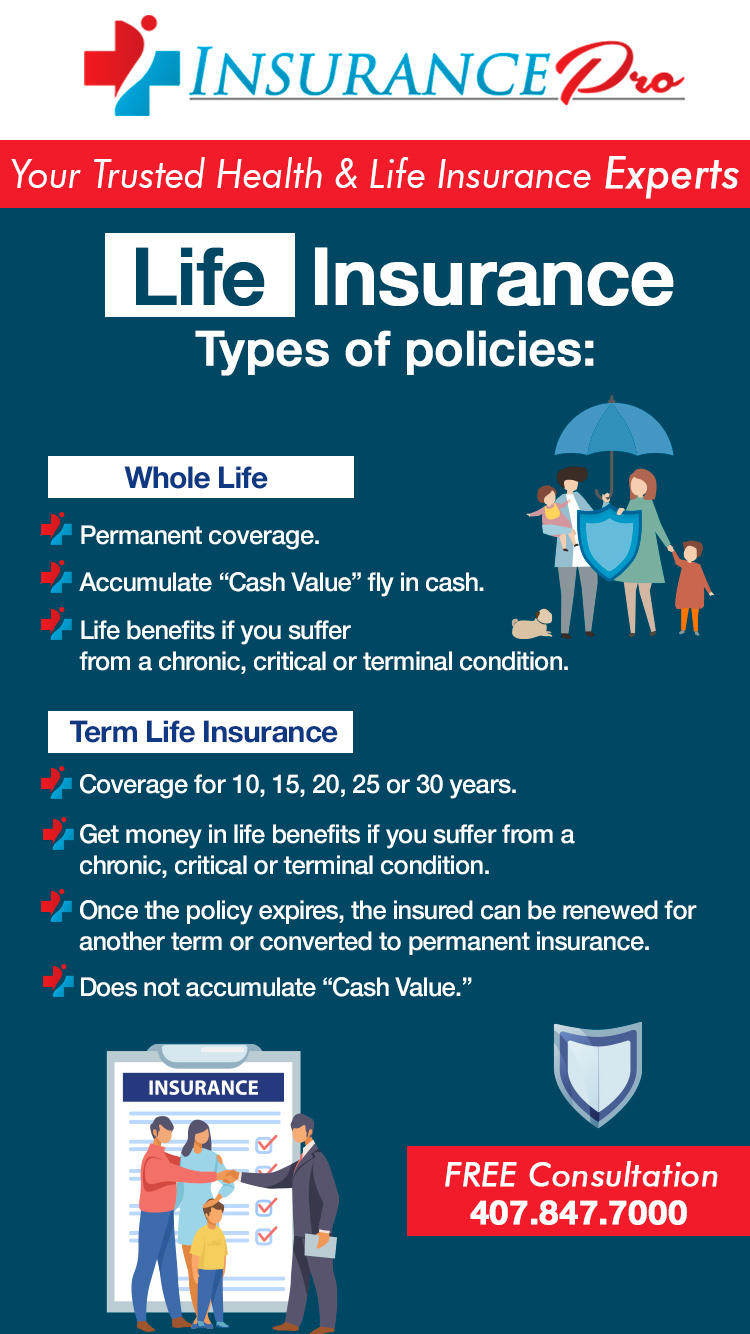

Insurance Pro Offers A Wide Range Of Life Insurance Policies

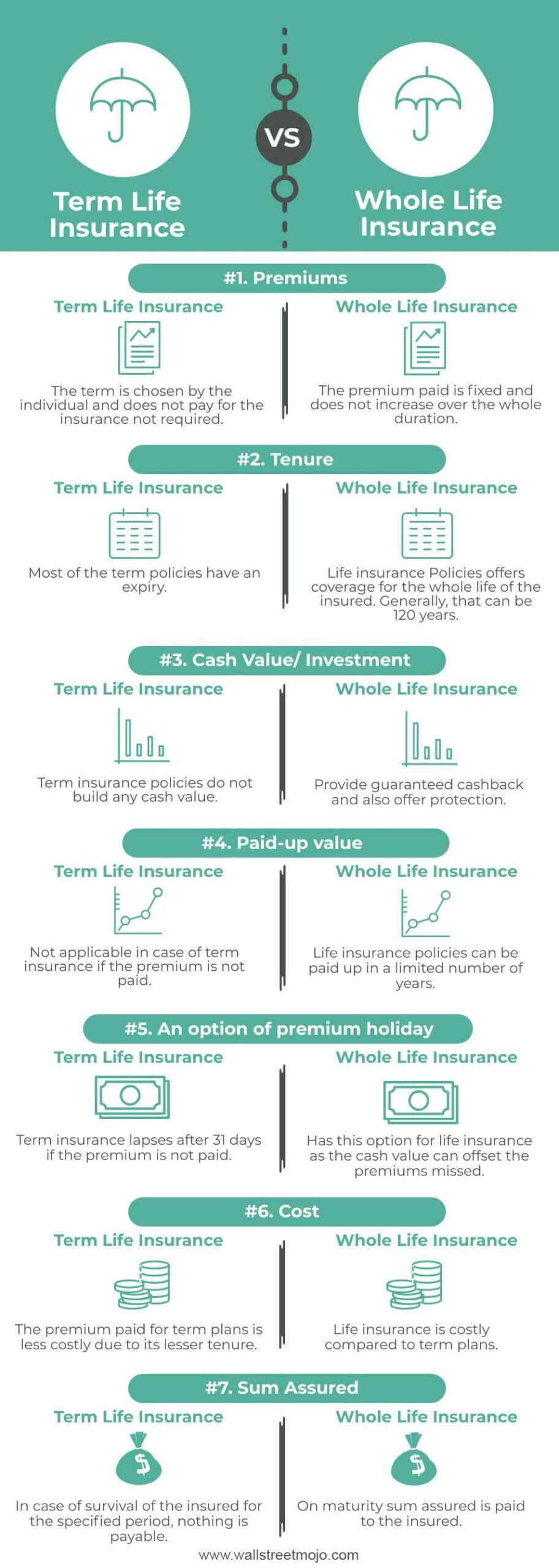

Term Life Vs Whole Life Insurance Which Insurance Is Better

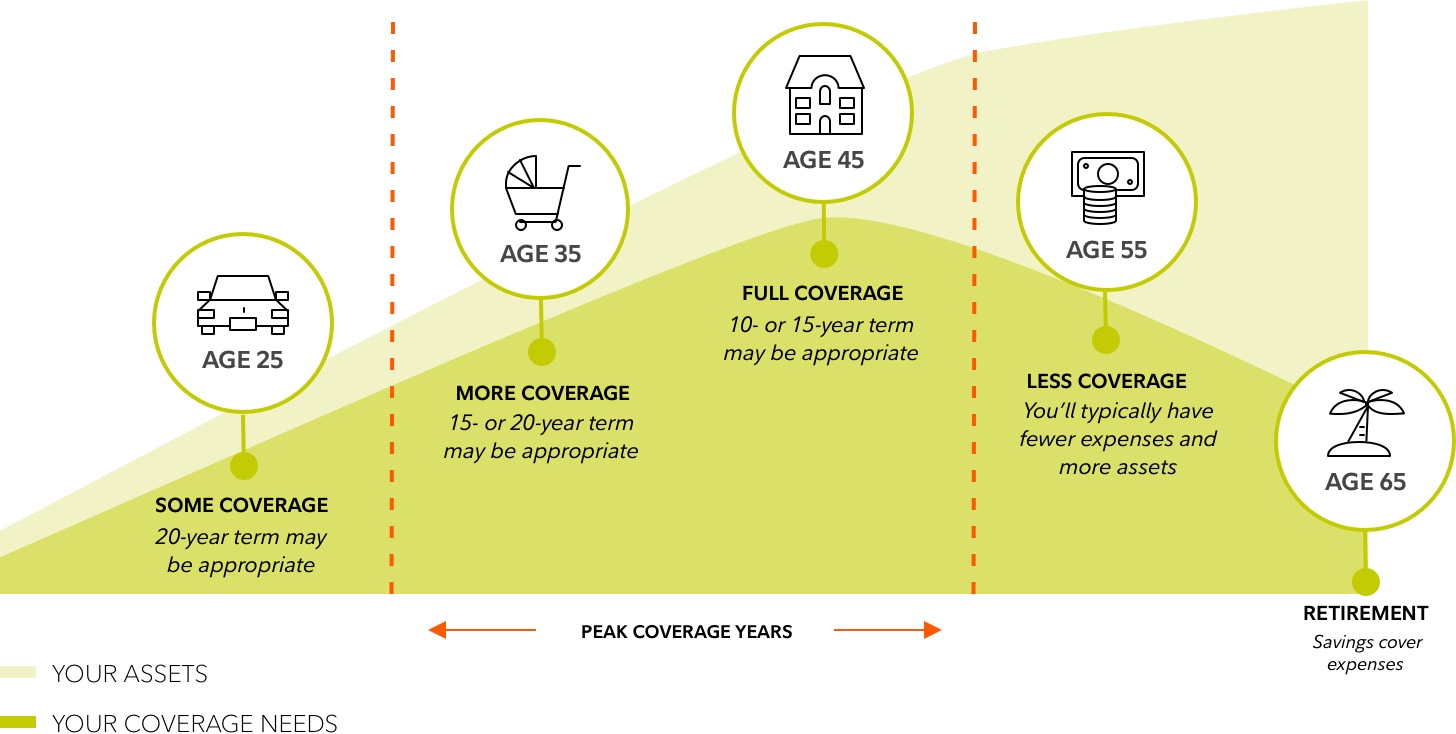

Term Life Archives Oliver Financial Planning

Compare Buy Best Term Life Insurance Policy For Your Life Stage Visual Ly

Term Life Insurance Financial Resources Coverage Options Fidelity

Can I Cash Out My Term Life Insurance Policy Quotacy Q A Fridays Youtube

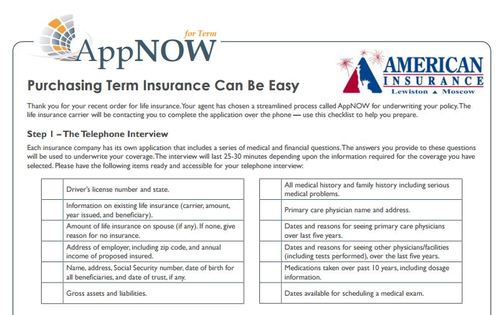

Term Life How Appnow Makes Getting Term Life Insurance Easy Faq American Insurance In Lewiston Amp Moscow Idaho

What Is Term Life Insurance Forbes Advisor

5 Year Term Life Insurance Policy Insurance Geek

Term Life Insurance Insider Tips Research Rates Insuranceproviders Com

How Much Does A 100 000 Life Insurance Policy Cost

Should I Renew My Term Life Insurance Policy Experian

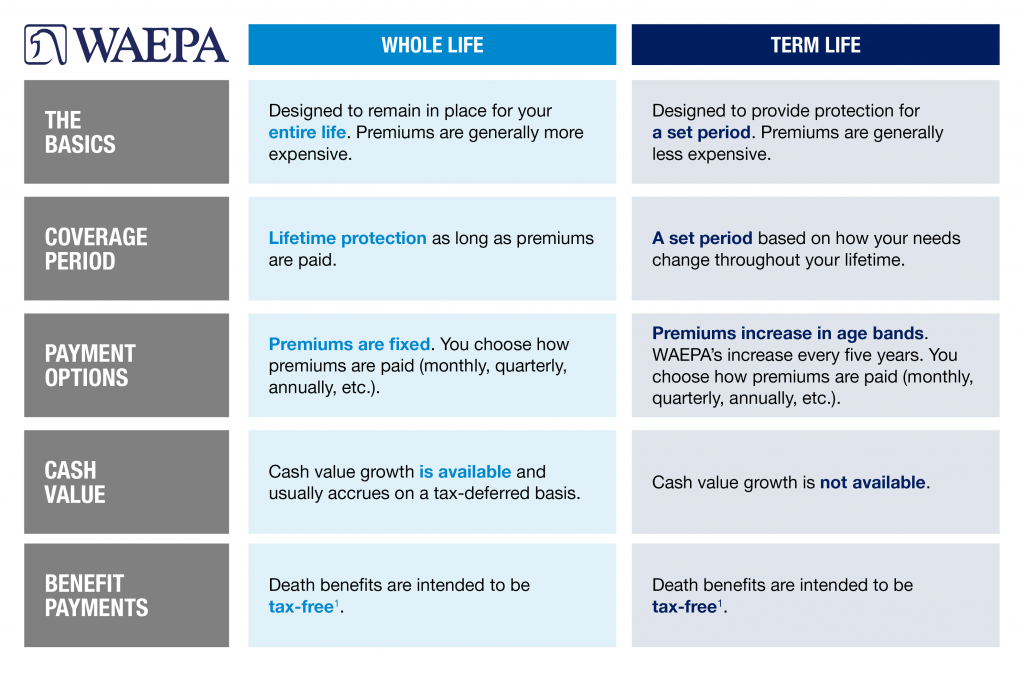

The Difference Between Term Whole Life Insurance Waepa

Ez Term Life Insurance Shelter Insurance

/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

Term Life Insurance What It Is Different Types Pros And Cons